Google had a pair of high-ranking executives leave this week. The first was Bill Ready, Google’s “President of Commerce, Payments & Next Billion Users,” who left to become CEO of Pinterest. The second big departure is Javier Soltero, who was vice president and GM of Google Workspace, Google’s paid business app, and was the leader of Google Messaging. Both executives made big changes to Google in their nearly three-year stints at the company. Now that they are leaving, it’s unclear what the future of their respective products holds.

Ready was only at Google for two-and-a-half years, where his highest-profile move was presiding over the disastrous rollout of a significant Google Pay revamp. The new Google Pay app was spearheaded by Ready’s payments team, led by another recently ousted executive, Caesar Sengupta. The Google Pay revamp brought an app originally developed for India to the US, where the requirement for phone number-based identity came with a huge list of downgrades: The Google Pay website had to be stripped of payment functionality, the app no longer supported multiple accounts, and you couldn’t be logged in to multiple devices.

The rollout of the new app was also clumsy. Slowly, over a month or two, users were kicked out of the old Google Pay and had to transition to a new app. The new identity system wasn’t backward compatible with the old Google Pay, though, which meant users still on the old app couldn’t send money to users on the new app.

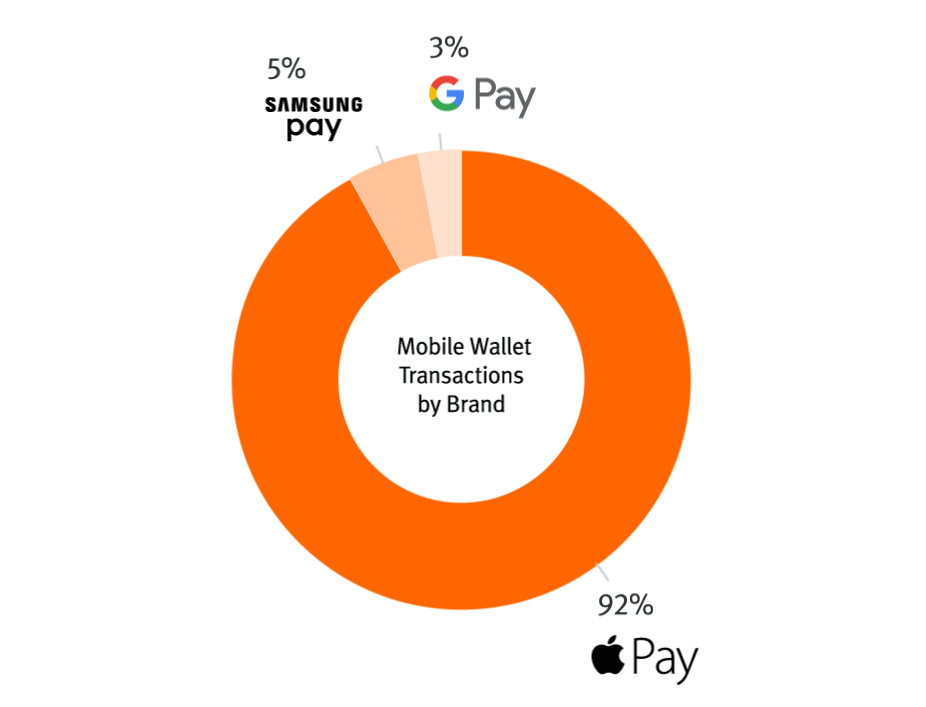

According to Pulse network (a wing of Discover card) Google Pay has 3 percent of the entire US NFC market. Keep in mind Google entered this market years before Apple.

The new Google Pay was announced one year into Ready’s tenure at Google and launched in March 2021. The app initially came with big plans for expansion, including a wild announcement of Google-branded bank accounts. Sengupta left Google one month after the US launch of the new Google Pay, which triggered an “exodus” of employees, according to Insider. The report said, “Dozens of employees and executives” left the payments team after Sengupta’s departure, with one employee saying there was “frustration” the new Google Pay “wasn’t growing at the rate we wanted it to.”

What happened afterward seems like a complete scrapping of the original “New Google Pay” game plan. Google generally launches a product in the US first and then slowly rolls it out to the rest of the world, but after the initial poor reception, the new Google Pay never saw a wide rollout outside of the US. Google canceled its heavily promoted plans for a Google bank account, even though, according to the Wall Street Journal, the company already had 400,000 curious users sign up for the public waitlist.

Ready appointed a new leader of Payments this January, a move Bloomberg described as a “reset” of Google’s payments strategy. Ready also made headlines at the time by saying, “Crypto is something we pay a lot of attention to,” though no Google product has emerged.

Four months later, at Google I/O 2022, another revamp of Google Pay was announced, re-branding the product to “Google Wallet.” That’s right, after a big revamp of Google’s payment app in 2021, there’s now another new revamp in 2022. Ready is now leaving five months after appointing a new Payments lead and setting these plans in motion, but he won’t be around for the launch of Google Wallet. Between the departure of old Payments lead Sengupta, Sengupta’s boss, Ready, and “dozens” of team members, it sure seems like the payments team ended up cleaning house.

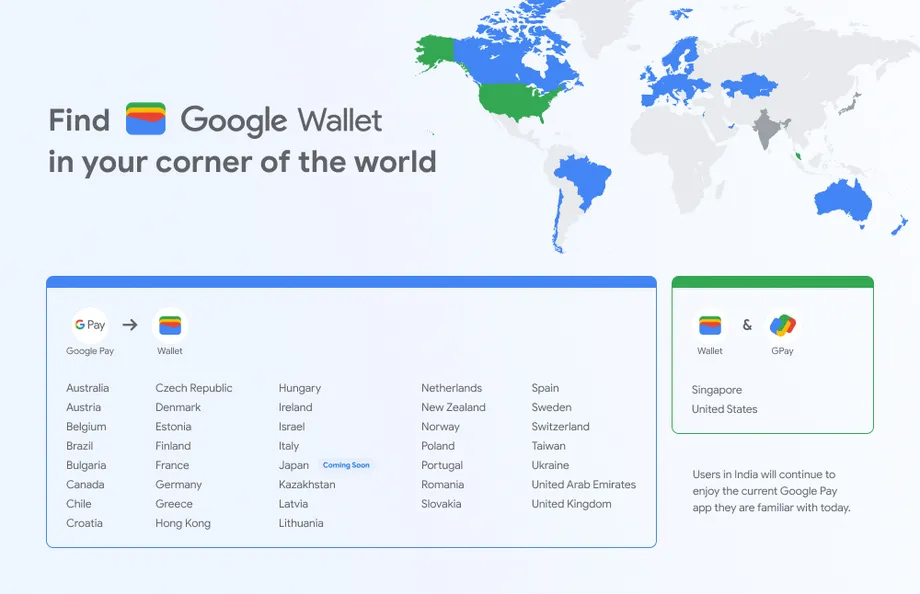

This nightmare of a map has the US with Google Pay and Google Wallet co-existing, while the rest of the world gets a cleaner solution of one payment app: Wallet.

At the heart of Google’s payments turbulence is probably the fact that most estimates put Google Pay at 3-4 percent of the US NFC payments market, which is way behind Apple’s nearly 92 percent market share. It’s an embarrassing loss considering Google was a pioneer in NFC payments and entered the market three years before Apple.

A big part of Google’s payment problems is this kind of instability, with Google’s payment app running through four different brands in 10 years (Google Wallet, then Android Pay, then Google Pay, now Google Wallet again). It still doesn’t seem like the company has arrived at a great solution with the new Google Wallet. The current plan—which could change once Ready’s replacement is hired—is for Google Wallet and Google Pay to co-exist in the US. In the rest of the world, there will be one payment app, Wallet, which sounds like a clean, reasonable offering. In the US and Singapore, though, Google doesn’t want to kill the widely panned new Google Pay app, so Google Wallet and Google Pay will be available. Why? If Wallet is rolling out to the rest of the world, the codebase clearly has the full payment feature set, why not just roll it out everywhere?

Google is still searching for a VP to replace Bill Ready, but the interim Payments president will be longtime Googler Nick Fox. Fox was previously front and center in the Google tech landscape as the head of Google messaging when the company produced Google Allo. Allo was Google’s main messaging app from 2016-2018, lasting about 576 days on the market. Since Allo, Fox has been running Google Search.